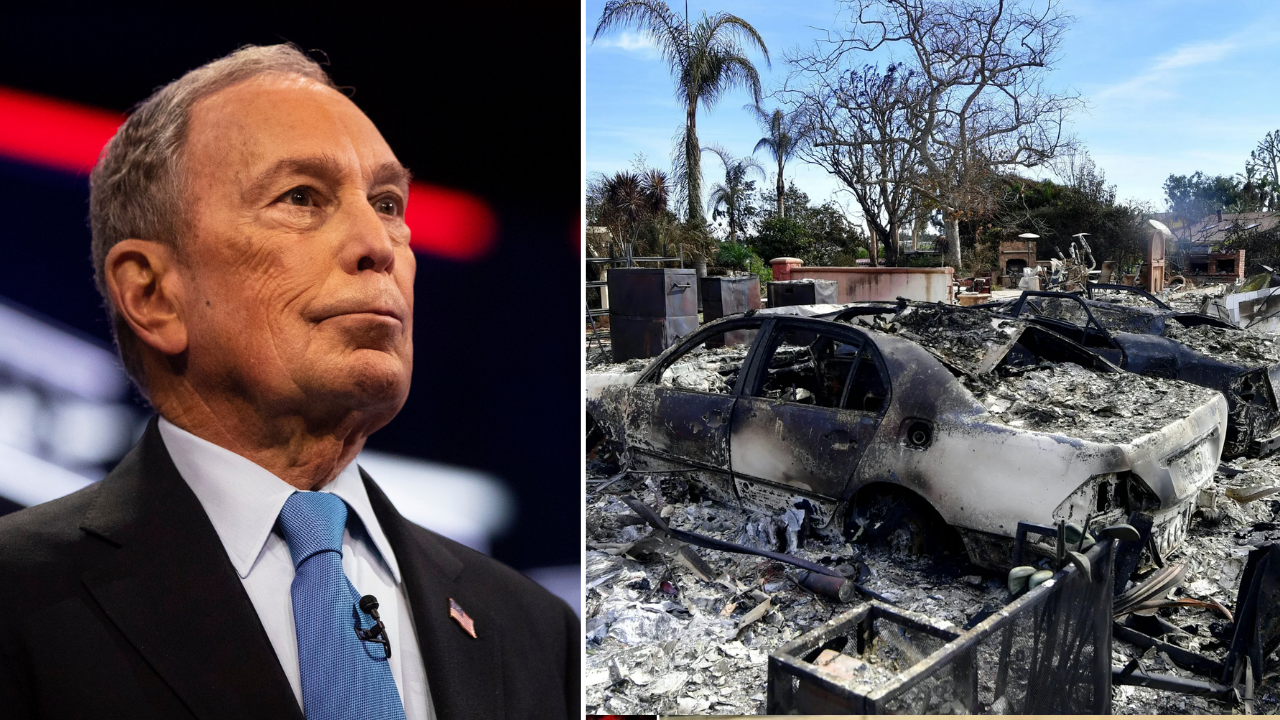

In a significant move to protect residents in the aftermath of the devastating wildfires in Los Angeles, California has officially banned insurance companies from canceling or refusing to renew residential property policies in areas hit by this week’s fires. The new mandate, confirmed by Bloomberg, aims to ensure that homeowners who have already suffered tremendous loss will not face additional burdens as they try to recover from the disaster.

A Bold Response to the Wildfire Crisis

The wildfires that recently swept through parts of Los Angeles County have left a trail of destruction, affecting thousands of residents and businesses. Homes have been reduced to ashes, and many families are now left grappling not only with their loss but with the fear of losing their insurance coverage at a time when they need it most.

In response to the escalating crisis, California Governor Gavin Newsom and state regulators have intervened to prevent insurers from withdrawing coverage in these areas, signaling a bold response to an ongoing disaster.

Protecting Vulnerable Homeowners

The new ban will directly impact homeowners whose properties have been damaged or destroyed by the fires. Many residents have been living in fear that their insurance providers would refuse to renew policies or, worse, cancel their coverage altogether, leaving them financially exposed in the aftermath of the destruction.

Under this emergency order, insurers will be prohibited from taking such actions for at least a specified period, giving homeowners more stability as they rebuild their lives. The goal is to ensure that property owners can access the coverage they need to repair and recover, without the added worry of losing their insurance protection.

“At this critical time, we cannot allow Californians who have already lost so much to face the additional burden of losing their insurance coverage,” said Newsom in a statement. “This action will provide much-needed relief to residents and help the state recover more quickly from this crisis.”

The Impact on the Insurance Industry

Insurance companies, already grappling with the financial strain caused by an increase in natural disasters across the state, have expressed concerns about the long-term sustainability of such a mandate. The cost of covering properties in fire-prone areas has skyrocketed, prompting many insurers to reconsider the risk associated with these regions. Some have even pulled out of the state market entirely due to mounting losses.

Despite these concerns, the California Department of Insurance is committed to balancing the needs of the residents with the viability of the insurance market. The state has pledged to work closely with insurers to ensure they can continue to operate while providing necessary coverage to homeowners in vulnerable areas.

A Lifeline for Communities

For the neighborhoods devastated by the recent fires, the mandate comes as a much-needed lifeline. Many residents are still grappling with the aftermath, and the financial support of insurance companies will be crucial in rebuilding efforts. Without it, they would face not only the loss of their homes but also the financial devastation of having to pay for repairs out of pocket.

Local relief organizations and community leaders have also praised the state’s decision, recognizing that it will give families the breathing room they need to start the recovery process.

What’s Next for Fire-Impacted Areas?

As the ban takes effect, the focus will shift to the longer-term recovery efforts in the affected neighborhoods. In addition to insurance relief, state and local authorities are ramping up disaster relief efforts, with emergency shelters, food distribution, and mental health support services being deployed to assist those who have lost everything.

As the wildfires continue to pose an ongoing threat, Governor Newsom and state officials are working on further measures to mitigate the impact of future disasters. The state has pledged to continue efforts to increase wildfire preparedness and resilience, focusing on reducing risks for communities across California.

This move is a clear indication of California’s commitment to protecting its residents in the face of increasingly frequent natural disasters. With insurance companies now required to support fire victims, the state is taking a strong stance to ensure that its residents aren’t left stranded in their time of greatest need.